08 June 2020

NEXT GENERATION OF RETAIL – THE LEGACY OF CORONAVIRUS

By Kerem Cengiz, Managing Director – MENA, LWK + PARTNERS

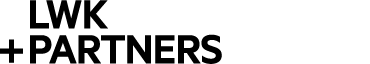

Retail has always been in a dynamic state of flux, evolving to change in society, economic conditions, urban population increase, and technology. Even before the outbreak of the COVID-19, retailers were embracing a movement towards a balance of mixed-uses to meet the commercial expectations of operators as traditional retail formats retracted as e-commerce grew.

The sudden and rapid spread of the pandemic has dramatically accelerated this shift in the thinking across the global retail environment: the need to adapt and survive to ensure commercial viability and the emotion and psyche of the shopper.

WHAT WILL WE WANT POST COVID-19?

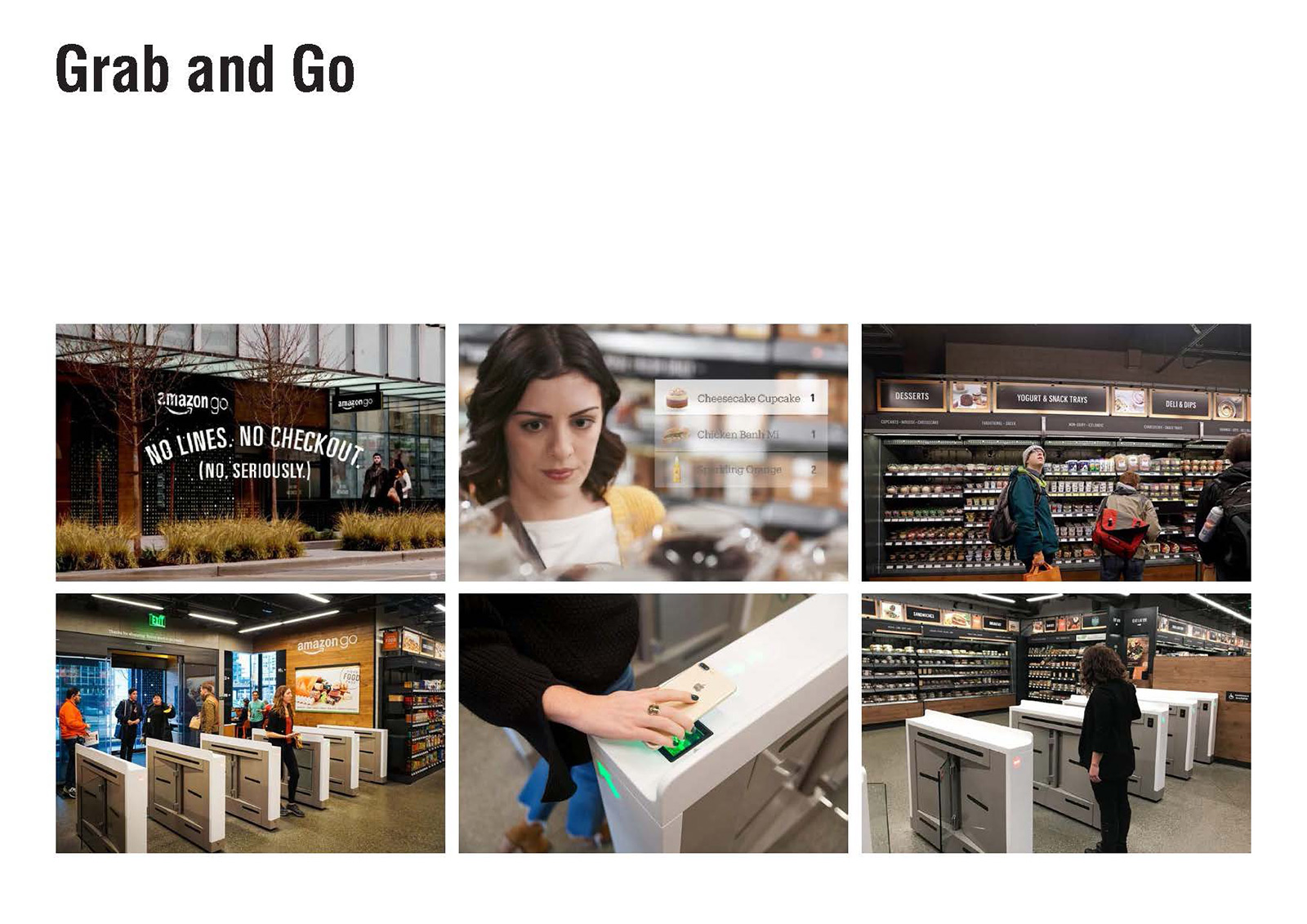

We anticipate a significant difference in expectations around demographic profile. Some will crave the traditional high-street, the corner store where we stop and chat to the storekeeper, the grocer, baker, butcher, fishmonger, tailor and so on. While younger generations will further embrace, and demand technology driven experiences as a prevalent across China and part of Southeast Asia.

It is inevitable that there will be retained fears around social gatherings, crowds and social interaction, yet others, after months of isolation, crave engagement and connection. Logistical challenges could fuel a significant increase in the demand for locally produces and sourced products, a stepping back from big chains. It goes without saying that a greater degree of touch-less amenities in retail spaces will become the norm with hygiene becoming overtly central.

How can retailers and mall management respond to these disparate demands? It is likely large malls will re-master plan to for smaller subdivided zones to avoid overcrowding; these smaller zones could be adapted to allow for social distance queuing, waiting areas for takeaway services, inclusion of central shopping pick-up zones.

Car parking areas could be remodelled to adapt for contactless supermarket pick-up zones, including separate access and refrigerated lockers with unique access codes etc. this could also be integrated for centralised contactless drive-through routes for food and beverage outlets and restaurants.

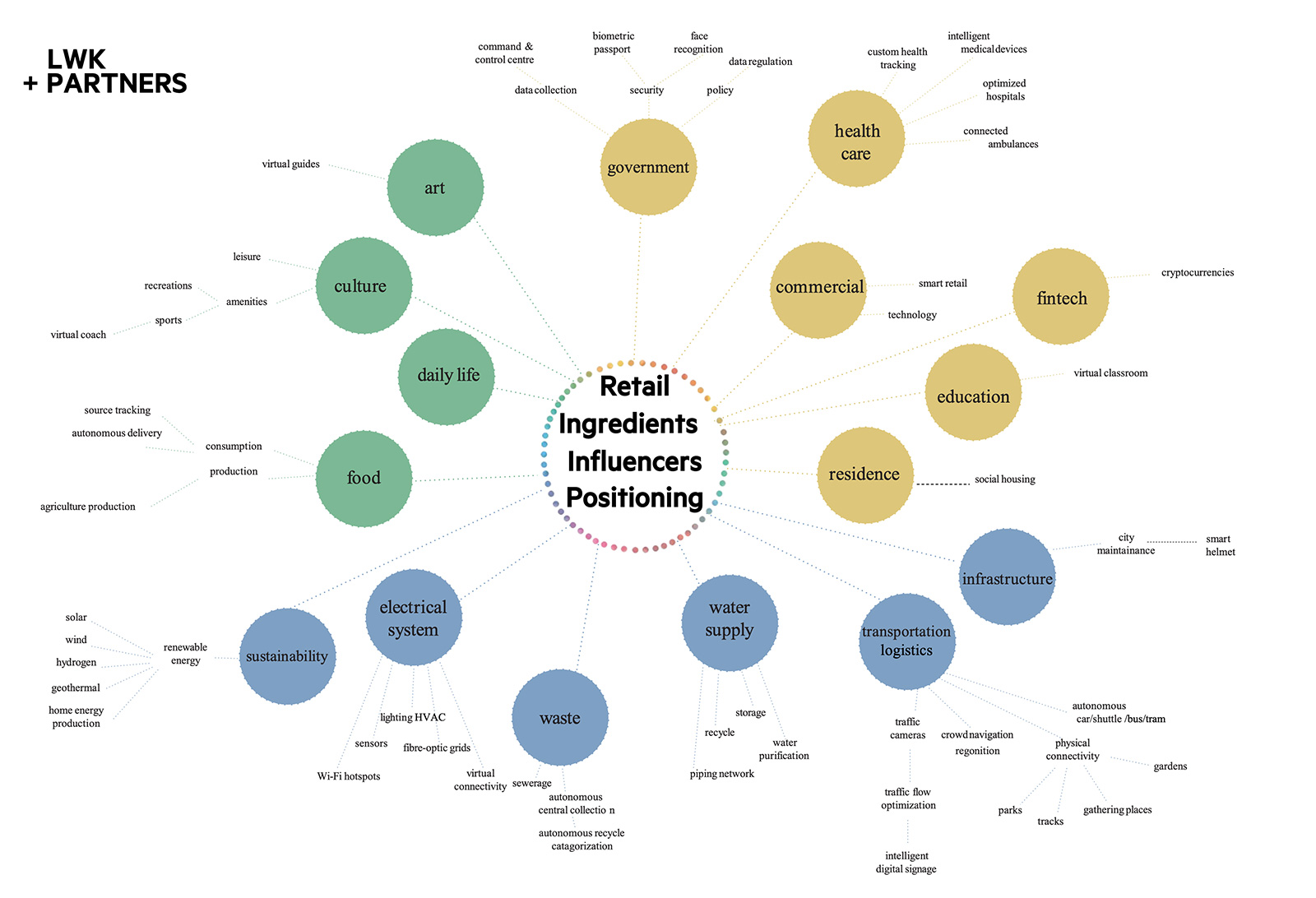

Fundamentally this goes further than the consumer interface but impacts considerably on back-of-house functionality. It is also likely that we shall see significant changes to the point-of-sale areas; potentially seeing a move towards technologically driven solutions including touch-free / frictionless transactions or even facial recognition solutions as either established and increasingly prevalent in the Chinese and Asian retail sectors.

Social distancing will certainly have deeper impacts on the operations of retail environments and malls. Not only on the retail logic and movement within a centre or store, maximum visitors, lift capacities, food courts and breakout areas and mall widths to ensure the recommended safe distances are maintained. Critically we fully anticipate that significant reconfiguration of HVAC systems will be undertaken to better treat and mitigate the removal of potentially contaminated air.

RETAIL IS BRANDS - OPERATIONS - SPACE

The brand and its operations

Omnichannel touch points and e-commerce have for some time now disrupted how brand express narrative, logistics and in some cases a physical presence. At the emergence of these trends some believed that brick and mortar was in its death throws, we have instead seen a balancing with the needs of human nature and psyche, the desire for human contact, the condition of the physical and the buzz of all-encompassing experiential shopping. Technological advances have seen the rise of the virtual mall offering sophisticated experiences and brands that have play-in-store / deliver-to-home options.

We recognise that malls and shopping destinations integrate hospitality and entertainment elements such as food courts, restaurants, bars and cinemas, which becoming reimagined with the emergence of centralised kitchens for app-based F&B delivery services such as Zomato, Talabat, Deliveroo and the like. Statistics show that as a global community, we take-out or get deliveries much more every year with a significant spike in the last three months.

Fast food brands and now increasingly, casual dining establishments understand that they no longer need a street-front presence to remain in existence and profitable. It is however unlikely that our need for social interaction and experiential dining will decrease as we see being voiced during this lockdown period across all Social media platforms, we cry out for it.

What Will All This Mean for Malls, Centres, Outlets and how they Operate?

Small shopping malls are increasingly becoming the centre of our communities, particularly within modern development communities across the middle east. During this pandemic we have witnessed that major malls in central locations have been impacted greatly, whilst most neighbourhood centres have continued to operate to relative normality, even increase in turn-over across particular sectors.

Neighbourhood centres tend to be focused on necessities rather than designer fashion, fine dining, and entertainment offers, and more on services acting as a one-stop-shop for the community with such as med-clinics, pharmacies, barbers, hairdressers, nail spas, gyms and services such as banking, currency exchanges, childcare and education, dry cleaners; affordable hospitality offerings; along with a supermarket retail provision such as grocers, affordable fashion and gift shops.

These community malls are adapting to include arts and cultural offers and attractive public realms to establish improved mobility, activity and safety. Such centres meet urban design principles that state that sustainable communities are built on the 20-minute-connectivity model.

While we are witnessing larger urban centres rapidly reviewing their existing models with anchor tenants pulling out or reducing square meterage. In such cases what can be done with these big box tenancies? Will be options to adapt or convert these spaces or will we see big blanks in the concourses?

Perhaps these adaptations could focus on personal shopping precincts; wellness/sports precincts; even medical facilities, play & education zones; e-sports venues, cultural spaces; adaptive co-workspaces, pop-up precincts or even temporary shelter to mention a few possibilities of planned and implemented well.

Adapting to disasters severely affects the logistics of mall and standalone retail destinations. We have seen this globally during this pandemic to varying degrees with the legislation around logistics and freight for grocery stores being eased to allow for 24-hour servicing.

There has been a move towards access-controlled loading docks including time slot booking for individual retailers and a shortfall for large vehicle waiting areas; with the rise in prevalence of contactless delivery direct delivery-to-tenancy more access will be required.

Future planning of our built retail environment must take this into account in, either with adaptations to existing malls and centres’ or for new developments yet to be designed or under construction to minimise disturbance to surrounding communities in which they are located and other operations in their neighbourhood.

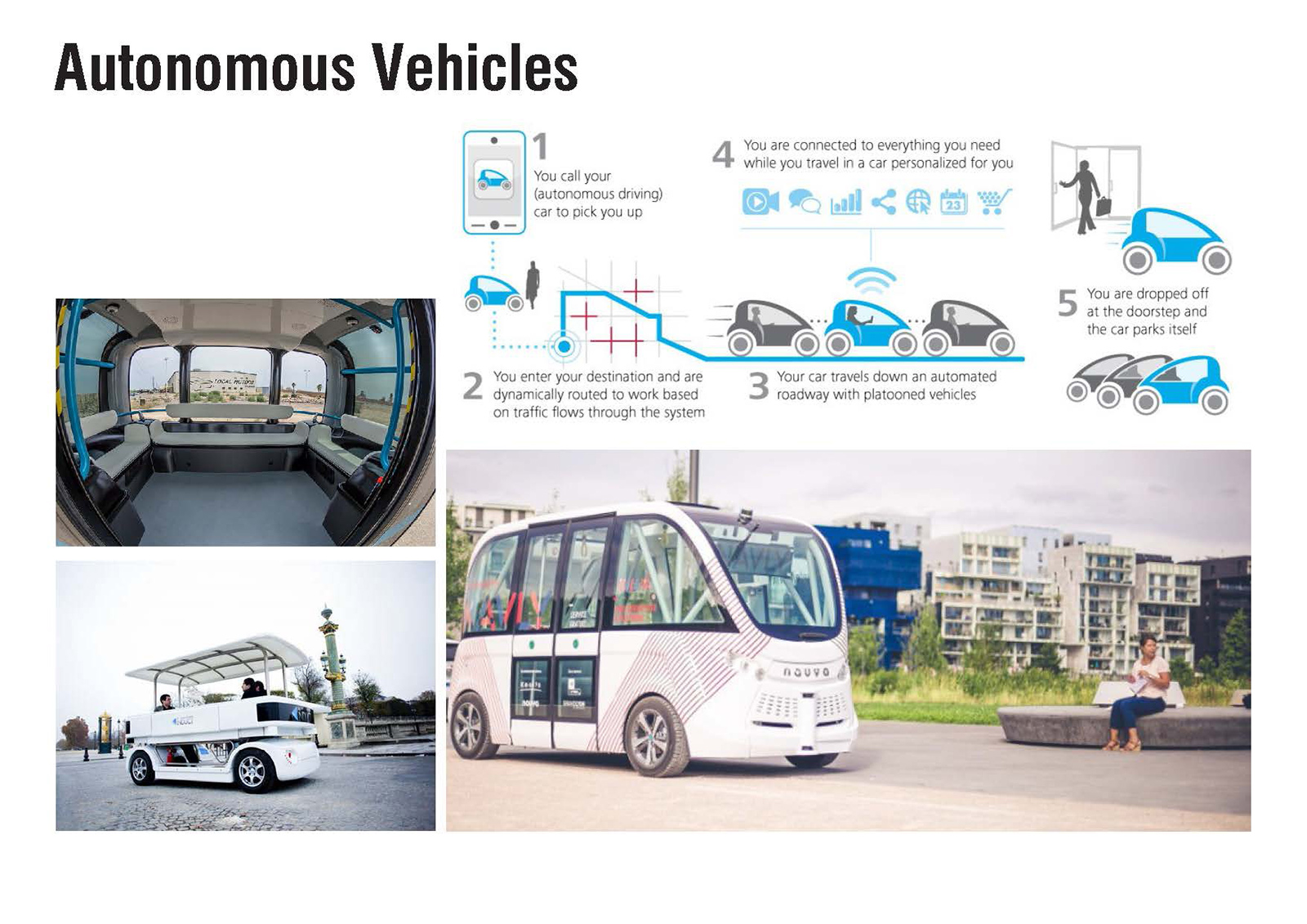

This will have a significant impact on traffic planning especially in our major cities and urban conurbations due to density of vehicular use, curb side delivery, and pick up locations. We may now expect to see and acceleration in the use of autonomous vehicles along with drone landing zones from large malls for delivery which will again change the way car parks are designed.

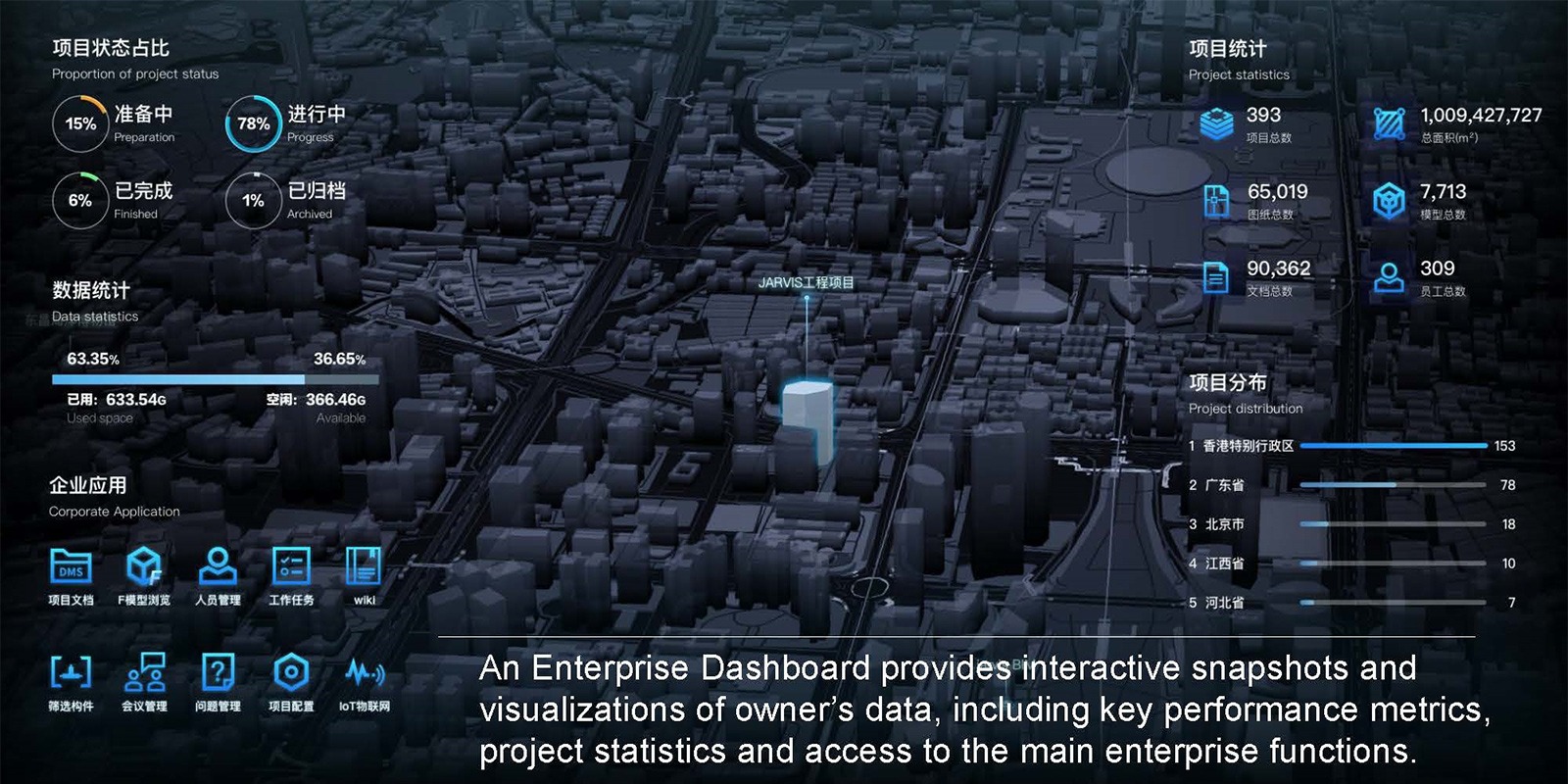

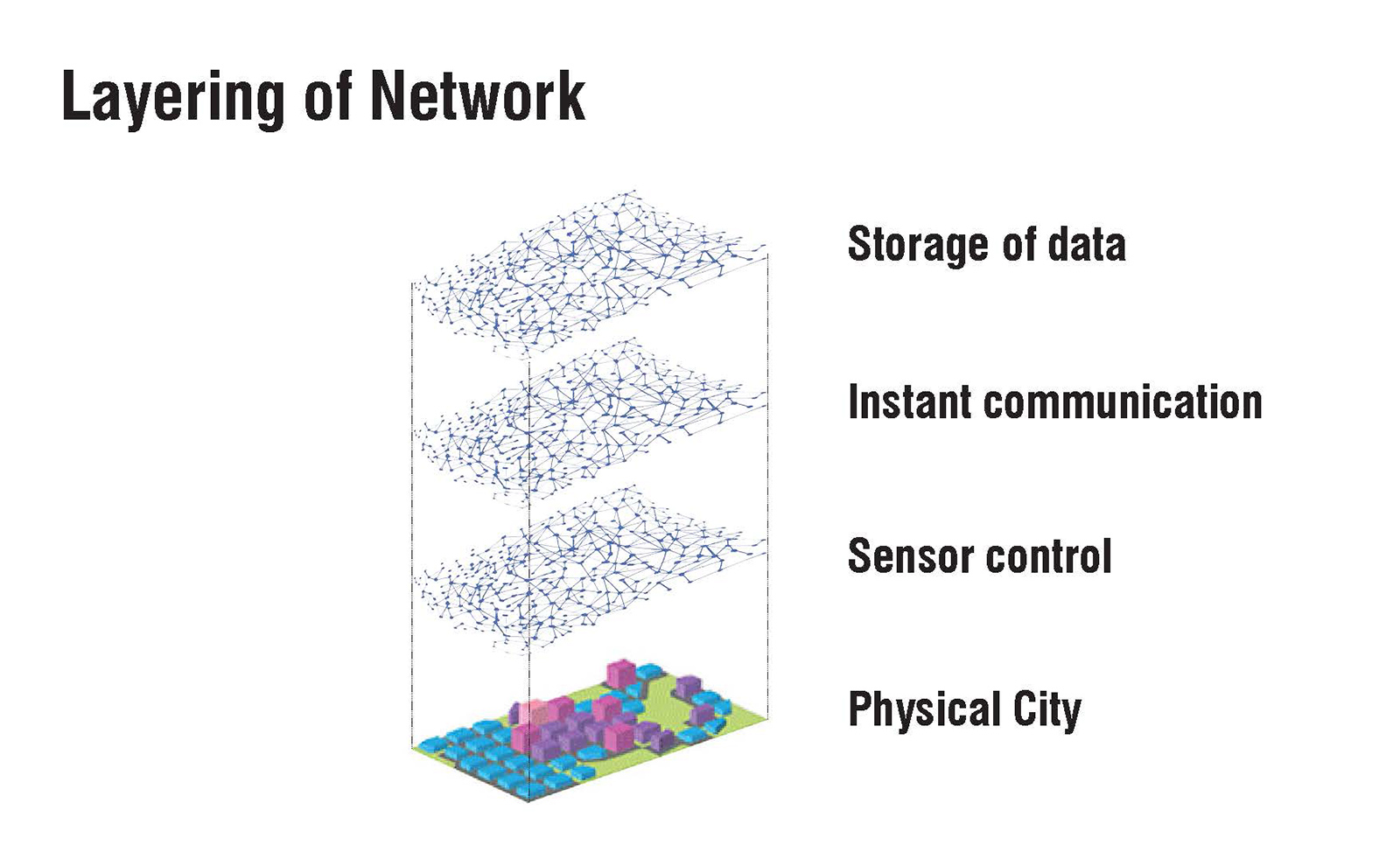

Warehouse, logistics and distribution centres are likely to move to automated alternatives to help with expedite supply and demand requirements, leading to frictionless operations and reduced staff numbers as we see in numerous other industries. This increase in connectivity will ramp-up investment in technology led infrastructure and in turn data centres… a fast forward to Smart City integration and Digital Transformation and the rise of the Digital Twin for assets, facilities and logistical management.

Retail centre and malls are now firmly recognised as essential provision providers during crisis such as this, the staff can become exposed and vulnerable essential workers. Back of house provision for staff must be improved from an occupational health and safety perspective as it is clear that many centres despite their best endeavours and falling short.

These all directly relate to Smart City technologies including smart parking and mobility, robotic technology for servicing deliveries and sanitisation, cost effective efficient operations, and sustainable considerations including automated waste collection and appropriate disposal.

Considering the Investment - The Asset

Mall and shopping centre owners have been massively hard hit and must ensure their developments are viable for the long term commercially, it is abundantly clear that they must diversify beyond retail – mixed-use is the way forward.

Relatively straight forward for new developments but can be done with parasitic structures on existing developments or adaption of adjacent sites, with uses broadening to include entertainment, hotels, co-work, and even transport nodes.

Sustainable design decisions now become a long-term economic benefit, a significant shift towards renewables, sustainable material, greywater use, etc, all of which will significantly minimise operating costs of large developments and protect the pockets of those that manage them.

We have seen a massive increase in vacant tenancies both in malls and the Highstreet due to the impact of COVID-19 and the tragic knock on economic and employment effect. This negatively impact on the owners of those tenancies. The question remains…how can we best re-purpose those spaces with viable long-term alternative?

Re-planning will have a central part to play in the re-allocation of space within malls and centre, we will see a significant increase in temporary pop-up providers to service our swiftly bored demographic with their ever-shifting fancies and expectations. We fully anticipate a significant change in the current lessee-lessor models the roles may well irreparably change.

Whatever happens in the next 18 months as a result of this pandemic, we are certain that retail is no doubt here for the long haul and yet how it decides to adapt, evolve and change will be fascinating to observe and be a part of influencing.